Sarcoidosis, a complex inflammatory disease, poses unique challenges for individuals seeking life insurance coverage. With the importance of financial security in mind, it becomes crucial to understand the intricacies involved in obtaining life insurance approvals for those affected by this condition.

This article delves into the relationship between life insurance and sarcoidosis, shedding light on the factors that influence underwriting decisions. By exploring the underwriting process, sharing practical tips, and examining real-life case studies, this article aims to empower individuals with sarcoidosis to navigate the complexities of obtaining life insurance coverage and secure the financial protection they deserve.

Understanding Sarcoidosis

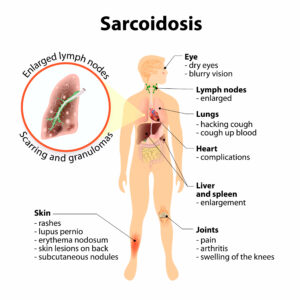

Sarcoidosis is a chronic inflammatory disease that can affect multiple organs in the body. Although its exact cause remains unknown, it is believed to involve an abnormal immune response. This condition is characterized by the formation of small clusters of inflammatory cells, known as granulomas, in various tissues and organs.

Causes of Sarcoidosis:

The exact cause of sarcoidosis is still a subject of research. However, it is thought to result from a combination of genetic predisposition and exposure to certain environmental factors. Some potential triggers include infections, certain chemicals, dust, and allergens. Additionally, there might be a link between sarcoidosis and an individual’s immune system being overly active or imbalanced.

Symptoms of Sarcoidosis:

Sarcoidosis can manifest in a wide range of symptoms, which largely depend on the organs affected. Common signs and symptoms include persistent cough, shortness of breath, chest pain, fatigue, fever, night sweats, weight loss, swollen lymph nodes, skin rashes or lesions, joint pain, and eye problems. It is important to note that sarcoidosis can have a diverse presentation, and symptoms can vary significantly from person to person.

Treatment of Sarcoidosis:

While there is no known cure for sarcoidosis, treatment is aimed at managing symptoms, reducing inflammation, and preventing organ damage. Treatment options depend on the severity of the disease and the organs involved. Mild cases may not require treatment, as the condition can sometimes resolve on its own. However, when treatment is necessary, corticosteroids are commonly prescribed to reduce inflammation. Other medications that suppress the immune system may be used in more severe cases or when corticosteroids are not effective. Regular monitoring and follow-up visits with healthcare providers are crucial to assess the disease’s progression and adjust treatment accordingly.

Worst-Case Scenario:

In rare cases, sarcoidosis can lead to severe complications and organ damage. The worst-case scenario may involve progressive fibrosis (scarring) of affected organs, such as the lungs, heart, liver, or kidneys. This can result in significant impairment of organ function and potentially life-threatening complications. Severe lung involvement can lead to respiratory failure, while cardiac sarcoidosis can cause heart rhythm abnormalities and heart failure. However, it’s important to note that these worst-case scenarios are relatively uncommon, and most individuals with sarcoidosis experience manageable symptoms with appropriate treatment and monitoring.

Impact on One’s Life Insurance Application

When applying for life insurance with sarcoidosis, the severity and management of the condition play a significant role in determining the outcome of the application. Insurance underwriters assess the risks associated with the applicant’s health condition to determine the appropriate premium rates and coverage. Generally, the impact on life insurance applications can be categorized as follows:

- Mild Sarcoidosis: Individuals with mild sarcoidosis, where the disease is well-managed and has minimal impact on organ function, are often eligible for preferred or standard life insurance rates. This assumes that the condition does not significantly affect daily activities, and there are no severe complications or impairments.

- Moderate Sarcoidosis: Moderate cases of sarcoidosis, where symptoms and organ involvement are more noticeable but still manageable, may qualify for standard life insurance rates. The underwriters will carefully review the applicant’s medical records, diagnostic tests, and treatment history to assess the overall stability of the condition and the individual’s ability to function.

- Severe Sarcoidosis: In cases where sarcoidosis has led to severe organ damage or complications, the likelihood of getting approved for traditional life insurance becomes more challenging. Individuals with severe sarcoidosis may face a higher chance of denial due to the increased risk associated with their health condition. Insurance providers may view these cases as posing a greater mortality risk, making it more difficult to secure coverage.

It’s important to note that each life insurance company has its own underwriting guidelines and criteria for evaluating sarcoidosis. Some insurers may be more lenient or specialize in offering coverage for individuals with specific medical conditions, including sarcoidosis. It’s recommended to work with an experienced insurance broker or agent who can help navigate the options and find suitable insurers.

Furthermore, the stability and management of sarcoidosis can also impact the waiting period before an individual can qualify for life insurance coverage. Insurance providers may require a certain period of stability, typically ranging from six months to several years, to ensure that the condition is well-managed and not likely to result in immediate complications.

Factors Affecting Life Insurance Approvals

Factors that will likely play a role in the outcome of one’s life insurance application may include:

- Underwriting process and its relevance to life insurance approvals: The underwriting process is a crucial component of life insurance applications, as it involves assessing the risks associated with an applicant’s health condition. Underwriters carefully review various factors, such as medical history, lifestyle choices, and overall health, to determine the insurability of an individual and set appropriate premium rates. Sarcoidosis, being a medical condition with potential complications, receives careful attention during the underwriting process.

- How sarcoidosis is assessed during the underwriting process: During the underwriting process, sarcoidosis is assessed based on several key factors. These may include the severity of the condition, the organs involved, the treatment history, and the stability of the disease. Underwriters evaluate the medical records and documentation provided by the applicant’s healthcare providers to gain insights into the current status of sarcoidosis and any associated complications. The underwriters may also consider additional diagnostic tests, such as imaging studies, pulmonary function tests, or cardiac evaluations, to assess the impact of sarcoidosis on organ function and overall health.

- Evaluation of medical records, tests, and reports for life insurance approval: Medical records, diagnostic tests, and reports are vital components in the evaluation of a life insurance application with sarcoidosis. Underwriters carefully review these documents to gain a comprehensive understanding of the applicant’s health condition. They assess the frequency and severity of symptoms, the response to treatment, any hospitalizations or surgeries related to sarcoidosis, and the presence of other health issues. The underwriters may also consider the applicant’s adherence to treatment plans and any lifestyle modifications undertaken to manage the condition effectively. The quality and completeness of the medical records and reports provided play a significant role in determining the outcome of the life insurance application.

Tips for Obtaining Life Insurance with Sarcoidosis

Importance of proactive management of sarcoidosis: Proactive management of sarcoidosis is crucial when applying for life insurance. By following treatment plans, taking prescribed medications, and regularly consulting healthcare providers, individuals can demonstrate their commitment to effectively managing their condition. Adhering to recommended lifestyle modifications and engaging in healthy habits, such as exercise and maintaining a balanced diet, can also contribute to better overall health and increase the chances of securing favorable life insurance terms.

Collaboration with healthcare providers for accurate documentation: Accurate and comprehensive documentation of medical records is essential when applying for life insurance with sarcoidosis. It is important to collaborate closely with healthcare providers and ensure that all relevant medical information, including diagnoses, treatment history, and test results, is properly documented. Regular communication with healthcare providers can help address any discrepancies or incomplete information that may arise during the underwriting process, ensuring that the insurance underwriters have a clear understanding of the individual’s health condition.

Researching and comparing life insurance providers and policies: When seeking life insurance coverage with sarcoidosis, it is important to conduct thorough research and compare different insurance providers and policies. Not all insurance companies have the same underwriting guidelines for sarcoidosis, and some may be more favorable towards applicants with this condition. By exploring various options and understanding the specific criteria of each insurance provider, individuals can identify companies that have experience in insuring individuals with sarcoidosis and offer competitive coverage terms.

Utilizing the expertise of insurance brokers or agents: Navigating the complexities of obtaining life insurance with sarcoidosis can be challenging. Engaging the expertise of insurance brokers or agents who specialize in impaired risk cases can greatly assist in the process. These professionals have in-depth knowledge of various insurance providers, their underwriting practices, and the specific requirements for individuals with sarcoidosis. They can provide valuable guidance, help gather the necessary documentation, and negotiate on behalf of the applicant to secure the most favorable life insurance coverage.

In conclusion…

Obtaining life insurance with sarcoidosis requires proactive management of the condition, accurate documentation, thorough research, and expert guidance. By taking these tips into consideration, individuals can enhance their chances of securing life insurance coverage that meets their needs while effectively managing their health condition.