Polycystic Kidney Disease (PKD) is a genetic disorder that affects the kidneys, causing the growth of fluid-filled cysts and potential organ damage. It is a chronic condition that can have a significant impact on an individual’s health and life expectancy. In the face of this uncertainty, obtaining life insurance becomes a vital consideration for individuals with PKD and their loved ones.

This article aims to delve into the world of life insurance approvals for those living with PKD. We will explore the challenges faced by individuals with PKD when seeking life insurance coverage and provide insights into the factors that influence the approval process. Additionally, we will offer practical tips and case studies to help individuals with PKD navigate the complexities of securing life insurance coverage.

Understanding Polycystic Kidney Disease (PKD)

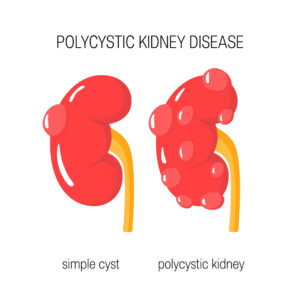

Polycystic Kidney Disease (PKD) is a genetic disorder characterized by the growth of multiple fluid-filled cysts in the kidneys. These cysts gradually enlarge over time, causing the kidneys to increase in size and lose their normal function. PKD is inherited, meaning it is passed down from parents to their children through genetic mutations. It is considered one of the most common genetic diseases, affecting millions of individuals worldwide.

Types of PKD (autosomal dominant and autosomal recessive):

There are two primary types of PKD: autosomal dominant polycystic kidney disease (ADPKD) and autosomal recessive polycystic kidney disease (ARPKD). ADPKD is the most common form and usually manifests in adulthood. It occurs when a person inherits a mutated gene from one affected parent. ARPKD, on the other hand, is a rarer and more severe form that typically presents in infancy or childhood. It requires the inheritance of two mutated genes, one from each parent.

Symptoms and progression of PKD:

In the early stages, PKD may be asymptomatic or cause mild symptoms, making it challenging to diagnose. As the cysts grow larger and multiply, symptoms can manifest, including abdominal pain, high blood pressure, blood in the urine, frequent urinary tract infections, kidney stones, and kidney failure. The progression of PKD varies among individuals, with some experiencing a slow decline in kidney function over many years, while others may develop complications at a younger age.

Impact of PKD on life expectancy:

When it comes to life insurance applications for individuals with PKD, the severity and type of PKD play a significant role in the approval process. Here’s how the impact varies:

- Mild case of PKD: If an individual has a mild case of PKD with minimal symptoms and a slow progression of the disease, they may have a better chance of qualifying for life insurance coverage. Insurance providers may offer substandard or table rates, which means the premium rates might be higher than average due to the increased risk associated with PKD. However, it is important to note that each insurance company has its own underwriting guidelines, and the specific details of the individual’s medical history and current health condition will be considered during the evaluation.

- Autosomal Dominant PKD (ADPKD): Individuals with ADPKD, the most common and typically more severe form of PKD, may face more challenges in obtaining life insurance coverage. Due to the progressive nature of ADPKD and the potential complications it can cause, insurance providers may view it as a higher risk. As a result, they may either deny coverage or offer coverage at significantly higher premiums. In some cases, individuals with ADPKD may need to explore alternative options such as guaranteed issue or accidental death policies that have less stringent underwriting requirements.

It is essential for individuals with PKD to be prepared for the possibility of facing limitations or denials when applying for traditional life insurance coverage. Understanding the potential impact of their PKD condition can help them set realistic expectations and explore other options available to secure the necessary coverage. Working with an experienced insurance agent or broker who specializes in high-risk cases, such as those involving PKD, can also be beneficial in navigating the application process and finding suitable coverage options.

Factors Affecting Life Insurance Approval with PKD

Medical history and current health condition: Insurance providers carefully evaluate an individual’s medical history and current health condition when assessing life insurance applications. For individuals with PKD, several factors within their medical history can impact the approval process.

These include:

- Frequency of renal infections: Recurrent renal infections can indicate a more severe form of PKD and potential complications, which may increase the risk in the eyes of insurance providers.

- Complications such as hypertension and cardiovascular issues: PKD can lead to high blood pressure and cardiovascular problems. The presence of these complications can influence the underwriting decision and affect the availability and cost of life insurance coverage.

- Family history of PKD: Insurance companies often inquire about a family history of PKD, as it may indicate a higher risk for the individual. If there is a known genetic predisposition within the family, it can impact the underwriting process.

Treatment and management of PKD:

The treatment and management of PKD can also influence life insurance approvals. Insurance providers consider the following factors related to PKD treatment:

- Medications and their side effects: Some medications used to manage PKD, such as blood pressure medications, may have potential side effects. These side effects can be taken into account during the underwriting process.

- Dialysis or kidney transplant considerations: If an individual with PKD requires dialysis or has undergone a kidney transplant, it can significantly impact the approval process. Insurance providers may want to assess the success of the treatment and the stability of the individual’s health post-treatment.

Collaboration with healthcare professionals and specialists:

Collaborating with healthcare professionals and specialists is crucial for individuals with PKD during the life insurance application process. The following steps can help strengthen the application:

- Providing comprehensive medical records and test results: Sharing detailed medical records, including diagnostic tests, imaging results, and laboratory reports, can provide a clear picture of the individual’s health status and help insurance providers evaluate the risks more accurately.

- Obtaining support letters from treating physicians: Support letters from healthcare professionals, such as nephrologists or urologists, can offer valuable insights into the individual’s PKD management, treatment compliance, and overall health prognosis. These letters can strengthen the case for life insurance approval.

By addressing these factors and collaborating closely with healthcare professionals, individuals with PKD can present a well-rounded and comprehensive application to insurance providers. This proactive approach can enhance the chances of securing life insurance coverage that meets their specific needs.

Tips for Obtaining Life Insurance with PKD

- Research and compare different insurance companies: It is essential to conduct thorough research and compare offerings from different insurance companies. Not all insurance providers have the same underwriting guidelines or views on PKD. Look for companies that have experience dealing with high-risk conditions like PKD and consider their track record in providing coverage to individuals with similar health profiles.

- Disclose all relevant medical information: When applying for life insurance, complete honesty and full disclosure of your medical history, including your PKD condition, is crucial. Insurance companies have access to medical records and can uncover any withheld information during the underwriting process. Failure to disclose relevant details can lead to denial of coverage or even policy cancellation in the future.

- Provide a comprehensive overview of PKD management and treatment: Create a comprehensive overview of your PKD management and treatment plan. Include information about regular check-ups, medications, lifestyle modifications, and any other measures taken to manage the condition effectively. Demonstrating a proactive approach to managing PKD can help reassure insurance providers about your commitment to maintaining good health.

- Consider working with an experienced insurance agent or broker: Engaging the services of an insurance agent or broker experienced in handling high-risk cases, such as PKD, can be highly beneficial. These professionals understand the nuances of the underwriting process and can guide you through the application, ensuring that all necessary information is accurately presented to insurance companies. They can help navigate complex policies, negotiate on your behalf, and increase the chances of obtaining favorable coverage terms.

- Explore alternative options such as guaranteed issue or accidental death policies: If traditional life insurance coverage proves challenging to obtain due to PKD, consider exploring alternative options such as guaranteed issue or simplified issue policies. These types of policies typically have less stringent underwriting requirements and may be suitable for individuals with pre-existing conditions like PKD. While these policies may come with certain limitations or higher premiums, they can provide a viable solution for securing some level of life insurance coverage.

Remember that each individual’s situation is unique, and the availability of options may vary based on factors such as age, overall health, and the specific details of the PKD condition. By following these tips and seeking professional guidance, individuals with PKD can improve their chances of finding suitable life insurance coverage that provides the necessary financial protection for themselves and their loved ones.