In this article, we will explore the impact of osteomyelitis on life insurance approvals and provide valuable insights to help individuals navigate the process successfully.

Understanding Osteomyelitis

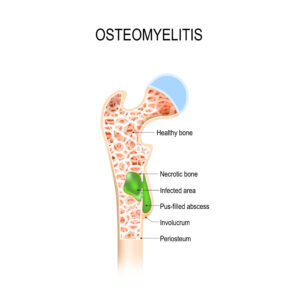

Osteomyelitis is an infection that can occur in any bone in the body. It is typically caused by bacteria, although it can also be caused by fungi or other pathogens. The infection can develop either as a result of a direct bone injury or through the spread of bacteria from other parts of the body through the bloodstream.

Causes:

There are several ways in which osteomyelitis can develop:

- Open Wound Infection: Osteomyelitis can occur when bacteria enter the body through an open fracture, surgical incision, or deep puncture wound. The bacteria can then spread to the nearby bone, causing infection.

- Bloodstream Infection: Bacteria from infections in other parts of the body, such as urinary tract infections or pneumonia, can enter the bloodstream and be carried to the bones, leading to osteomyelitis.

- Contiguous Spread: In some cases, infections in adjacent tissues, such as skin or muscle, can spread to the underlying bone, resulting in osteomyelitis.

- Vascular Insufficiency: People with poor blood supply to the bones, such as those with diabetes or peripheral artery disease, are more susceptible to developing osteomyelitis due to compromised bone health.

Symptoms:

The symptoms of osteomyelitis can vary depending on the severity of the infection and the individual. Common signs and symptoms include:

- Persistent or Intense Bone Pain: The affected area may be tender, swollen, and painful. The pain may worsen with movement or pressure.

- Fever and Chills: Osteomyelitis can cause systemic symptoms, including fever, chills, and overall malaise.

- Localized Swelling and Redness: The infected area may become swollen, warm to the touch, and exhibit redness or discoloration of the skin.

- Limited Range of Motion: If osteomyelitis affects a joint, it can cause stiffness and restricted movement in the affected area.

- Drainage of Pus: In some cases, the infection may lead to the formation of an abscess, resulting in the drainage of pus through the skin.

Treatment:

The treatment approach for osteomyelitis typically involves a combination of medical interventions and surgical procedures:

- Antibiotics: Intravenous (IV) antibiotics are the primary treatment for osteomyelitis. The choice of antibiotics depends on the specific bacteria causing the infection and may require several weeks or even months of treatment.

- Surgical Debridement: In severe cases, surgical debridement may be necessary to remove infected bone tissue, pus, and foreign material. This helps in clearing the infection and promoting healing.

- Bone Grafts: In cases where significant bone loss has occurred, bone grafts may be performed to replace the infected bone with healthy bone tissue.

- Hyperbaric Oxygen Therapy: In certain situations, hyperbaric oxygen therapy, which involves breathing pure oxygen in a pressurized chamber, may be used to promote wound healing and fight the infection.

Worst-Case Scenario:

If left untreated or inadequately treated, osteomyelitis can lead to serious complications, including:

- Chronic Infection: Osteomyelitis can become a chronic condition, with recurrent or persistent infections that are difficult to treat.

- Bone Necrosis: The infection can cause the death of bone tissue, resulting in a condition called bone necrosis or osteonecrosis. This can weaken the affected bone, leading to fractures and deformities.

- Spread of Infection: If not properly managed, the infection can spread to surrounding tissues, such as muscles, tendons, or joints, causing further damage and increasing the risk of systemic infection.

- Septicemia: In severe cases, the infection can enter the bloodstream, leading to septicemia or sepsis. This is a life-threatening condition characterized by widespread infection throughout the body, which can result in organ failure and even death if not treated promptly.

- Amputation: In rare and severe cases where the infection is not controlled, amputation of the affected limb may be necessary to prevent the spread of infection to other parts of the body and to save the individual’s life.

It is crucial to seek prompt medical attention and adhere to the prescribed treatment plan to prevent these worst-case scenarios from occurring. Early diagnosis and appropriate management significantly improve the prognosis for individuals with osteomyelitis.

Impact on one’s life insurance application

The impact of osteomyelitis on a life insurance application can vary depending on the severity of the underlying condition and the presence of ongoing complications or pre-existing medical conditions. Here are some key considerations:

- Mild Infection and Full Recovery: If an individual has experienced a mild case of osteomyelitis, with no ongoing complications and a full recovery, they may still be eligible for life insurance coverage. In such cases, the insurance underwriters may classify the applicant as a substandard risk, meaning they may be offered coverage at a higher premium rate compared to individuals without a history of osteomyelitis.

- Continued Complications or Ongoing Medical Conditions: If the applicant continues to experience complications from osteomyelitis or has other pre-existing medical conditions, the life insurance underwriters will review each situation on a case-by-case basis. The severity and impact of these complications will play a significant role in determining coverage eligibility and premium rates.

Case-by-Case Evaluation: Insurance companies will carefully assess the applicant’s medical records, including the details of the osteomyelitis diagnosis, treatment history, response to treatment, and any ongoing complications. They will also consider the individual’s overall health status, including the presence of other chronic medical conditions.

Possible Denial of Coverage: In some cases where the osteomyelitis has resulted in severe complications or the individual has significant ongoing medical conditions, there is a possibility of being denied coverage altogether. Insurance companies may deem such cases as too high risk or may be unwilling to provide coverage due to the potential financial liability.

It’s important to note that each insurance company has its own underwriting guidelines and risk assessment criteria. Therefore, it’s advisable to work with an experienced life insurance agent or broker who can navigate the application process and identify insurance providers more likely to consider applicants with a history of osteomyelitis.

Factors that will be considered

Life insurance companies assess risks associated with an applicant’s health conditions to determine coverage eligibility and premium rates. When evaluating an individual with osteomyelitis, insurers take several factors into account, including the severity of the infection, treatment history, and overall health status.

- Severity of the Infection: Insurance companies consider whether the osteomyelitis infection is acute or chronic. Acute infections are typically easier to treat and have a lower impact on life insurance applications compared to chronic infections.

- Treatment History: Life insurers review an applicant’s medical records to understand their treatment history. Individuals who have undergone successful treatments, such as surgery or long-term antibiotic therapy, may have a higher chance of obtaining life insurance approval.

- Overall Health Status: Apart from osteomyelitis, an individual’s overall health plays a crucial role in the insurance approval process. Insurance underwriters assess factors such as comorbidities, lifestyle choices, and the presence of any other chronic medical conditions.

Tips for Securing Life Insurance Approval with Osteomyelitis

While getting life insurance approval with osteomyelitis may pose challenges, it is not impossible. Consider the following tips to increase your chances of obtaining coverage:

- Provide Detailed Medical Information: When applying for life insurance, ensure you provide comprehensive medical information, including details about the diagnosis, treatment, and follow-up care for osteomyelitis. The more detailed and accurate your medical records, the better the chances of the underwriters understanding your condition.

- Maintain Open Communication: It is essential to communicate openly with the insurance company. Inform them about the steps you have taken to manage and control your osteomyelitis. This can include regular check-ups, adherence to prescribed medications, and any lifestyle modifications you have made to reduce risk factors.

- Seek Professional Assistance: Consulting an experienced life insurance agent or broker who specializes in high-risk cases can be immensely helpful. They can guide you through the application process, provide advice on appropriate coverage options, and negotiate on your behalf with insurance companies.

- Explore Different Insurance Types: If traditional life insurance policies are not attainable due to osteomyelitis, consider alternative options such as graded benefit or guaranteed issue policies. These policies may have higher premiums or lower coverage amounts initially but can be a stepping stone towards obtaining more comprehensive coverage in the future.

Factors to Consider While Comparing Insurance Quotes

When comparing life insurance quotes, keep the following factors in mind:

- Premium Rates: Ensure that you receive quotes from multiple insurers to find the most competitive premium rates for your coverage needs. However, bear in mind that rates may vary significantly depending on the severity of your osteomyelitis and overall health.

- Coverage Options: Evaluate the coverage options provided by different insurance companies. Consider the policy duration, death benefit amount, and any additional riders that may be relevant to your specific needs, such as a critical illness rider that covers complications related to osteomyelitis.

- Financial Stability and Reputation: Research the financial stability and reputation of the insurance companies you are considering. Look for insurers with a strong track record of paying claims promptly and providing quality customer service.

- Underwriting Flexibility: Inquire about the underwriting flexibility of the insurance companies. Some insurers may have more lenient underwriting guidelines for certain medical conditions, including osteomyelitis. Working with an agent who has knowledge of such insurers can be beneficial.

Conclusion…

Securing lif.e insurance approval with osteomyelitis may require some additional effort and considerations, but it is achievable. By understanding how osteomyelitis impacts the underwriting process, following the provided tips, seeking professional assistance, and comparing insurance options, you can increase your chances of obtaining the life insurance coverage you need