Life insurance provides financial security and peace of mind for individuals and their families. However, obtaining life insurance after experiencing a myocardial infarction (heart attack) can be a challenging process.

This is why, in this article, we will explore the complexities of securing life insurance after a myocardial infarction and provide valuable insights to help you navigate the approval process successfully.

Understanding Myocardial Infarction:

Myocardial infarction is the medical term for a heart attack. It refers to the interruption or blockage of blood flow to the heart muscle, resulting in the death of cardiac tissue. This blockage usually occurs due to the buildup of fatty deposits called plaque in the coronary arteries, which supply oxygen and nutrients to the heart.

Causes of Myocardial Infarction:

The most common cause of myocardial infarction is the formation of a blood clot (thrombus) within a coronary artery. This clot can partially or completely block the blood flow to the heart muscle, leading to a heart attack. The underlying factors that contribute to the development of a blood clot and subsequent heart attack include:

- Atherosclerosis: Atherosclerosis is the buildup of plaque in the arteries, which narrows the blood vessels and restricts blood flow. This condition is often caused by high cholesterol levels, high blood pressure, smoking, obesity, and a sedentary lifestyle.

- Coronary Artery Disease: Coronary artery disease refers to the progressive narrowing or hardening of the coronary arteries due to atherosclerosis. When these arteries become too narrow, they can no longer supply sufficient blood to the heart muscle, increasing the risk of a heart attack.

- Risk Factors: Several risk factors can increase the likelihood of experiencing a myocardial infarction, including age, family history of heart disease, obesity, diabetes, high blood pressure, high cholesterol levels, smoking, and a sedentary lifestyle.

Symptoms of Myocardial Infarction:

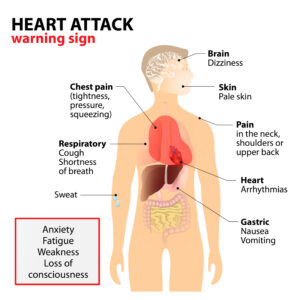

Recognizing the symptoms of a heart attack is crucial for seeking prompt medical assistance. The common symptoms of myocardial infarction include:

- Chest Pain or Discomfort: Most heart attacks involve discomfort in the center or left side of the chest. The pain may feel like pressure, squeezing, fullness, or tightness. It can last for a few minutes or come and go.

- Upper Body Discomfort: Pain or discomfort may extend beyond the chest to the arms (especially the left arm), back, neck, jaw, or stomach.

- Shortness of Breath: Feeling breathless or experiencing difficulty breathing can occur during a heart attack. This symptom may be accompanied by chest discomfort.

- Sweating, Nausea, and Lightheadedness: Other symptoms can include sweating, nausea, vomiting, dizziness, and a general feeling of being unwell.

It is important to note that symptoms may vary among individuals, and some people, especially women and older adults, may experience atypical symptoms or no chest pain at all.

Treatment Options for Myocardial Infarction:

Immediate medical treatment is essential when a heart attack occurs. The primary goals of treatment are to restore blood flow to the heart and prevent further damage. Common treatment options include:

- Medications: Various medications may be administered during a heart attack, such as aspirin, nitroglycerin, thrombolytics (clot-busting drugs), beta-blockers, and ACE inhibitors. These medications help reduce pain, prevent blood clots, and stabilize the heart.

- Percutaneous Coronary Intervention (PCI): Percutaneous coronary intervention, commonly known as angioplasty, is a procedure used to open blocked or narrowed coronary arteries. During PCI, a thin tube (catheter) with a deflated balloon at its tip is inserted into the blocked artery. The balloon is then inflated to compress the plaque and widen the artery, allowing for improved blood flow. In some cases, a stent (a small mesh tube) may be inserted to help keep the artery open.

- Coronary Artery Bypass Grafting (CABG): CABG is a surgical procedure that involves creating a bypass around the blocked or narrowed coronary arteries. During the surgery, blood vessels from other parts of the body are grafted onto the coronary arteries to bypass the blocked area and restore blood flow to the heart muscle.

- Cardiac Rehabilitation: After a heart attack, participating in a cardiac rehabilitation program can be beneficial. These programs involve supervised exercise, education about heart-healthy lifestyle changes, and emotional support to aid in recovery and reduce the risk of future cardiac events.

Worst-Case Scenario: Complications of Myocardial Infarction:

Although advances in medical treatment have significantly improved outcomes for heart attack patients, complications can still occur. Some potential worst-case scenarios associated with myocardial infarction include:

- Heart Failure: Severe damage to the heart muscle during a heart attack can weaken the heart’s pumping ability, leading to heart failure. This condition occurs when the heart cannot effectively pump enough blood to meet the body’s needs.

- Arrhythmias: Heart attacks can disrupt the normal electrical impulses in the heart, causing irregular heart rhythms or arrhythmias. Some arrhythmias may be life-threatening and require immediate medical intervention.

- Cardiogenic Shock: Cardiogenic shock is a severe condition that occurs when the heart is unable to pump enough blood to the body’s organs. It is a life-threatening complication of a heart attack and requires emergency medical treatment.

- Ventricular Septal Rupture: In rare cases, the heart muscle can be severely damaged during a heart attack, leading to a rupture in the wall that separates the ventricles (ventricular septal rupture). This condition requires immediate surgical intervention.

Impact on One’s Life Insurance Application

When applying for life insurance after experiencing a myocardial infarction, several factors come into play. Insurance providers evaluate the severity of the heart attack, the applicant’s overall health condition, and the underlying causes of the event. While each case is assessed individually, here are some potential outcomes based on different scenarios:

Full Recovery and Mild Heart Attack: If an applicant has made a full recovery from a mild heart attack and the underlying cause has been resolved, it is possible to qualify for a preferred rate. Insurance providers may consider such cases less risky since the heart attack was mild and the applicant has shown a positive recovery trajectory. It is important to provide detailed medical records and evidence of follow-up care to support the application.

Moderate to Severe Heart Attack: For individuals who have experienced a moderate to severe heart attack, the approval process becomes more complex. Insurance providers will closely examine the severity of the heart attack, the treatments received, and the overall health condition of the applicant. These cases are generally evaluated on a case-by-case basis, taking into consideration factors such as the time elapsed since the heart attack, the presence of any ongoing cardiac issues, and the applicant’s adherence to prescribed medications and lifestyle changes.

Underlying Health Conditions: The presence of underlying health conditions, such as diabetes, high blood pressure, or high cholesterol, in addition to a history of myocardial infarction, can impact the life insurance application. Insurance providers will evaluate the overall health of the applicant, including the control of these conditions, to assess the level of risk involved. Applicants who can demonstrate good management of their health conditions through regular check-ups, proper medication adherence, and lifestyle modifications may have a better chance of securing coverage.

Traditional Coverage Denial: In some cases, applicants who have experienced a myocardial infarction and do not meet the criteria for preferred rates or have significant underlying health conditions may be denied traditional coverage. Insurance providers have strict underwriting guidelines, and high-risk cases may not fit within their risk tolerance. However, it’s important to note that even in such cases, alternative options such as guaranteed issue or an accidental death policy may be available, although they often come with higher premiums and limited coverage amounts.

Factors Considered During the Application Process

Insurance providers assess the risk associated with an applicant’s medical condition before approving coverage. Myocardial infarction is considered a significant health event that raises concerns about the applicant’s overall health and mortality risk. However, securing life insurance is still possible with a history of heart attack. Here are some key factors that influence life insurance approval after a myocardial infarction:

- Time Since the Heart Attack: Insurance companies typically require a waiting period after a heart attack before considering an application. The waiting period varies among providers, but it is generally around six months to a year. This waiting period allows insurers to evaluate the applicant’s recovery and assess the risk of future cardiac events.

- Medical Records and Reports: Comprehensive medical records and reports play a crucial role in the life insurance approval process. Insurance companies review these documents to assess the severity of the heart attack, the underlying causes, treatment received, and the individual’s overall health status. It is essential to provide accurate and up-to-date medical information to the insurer to facilitate the evaluation process.

- Current Health Condition: Apart from the heart attack history, insurers consider the applicant’s current health condition. Factors such as blood pressure, cholesterol levels, body mass index (BMI), and overall cardiac health play a significant role in the approval decision. It is advisable to maintain a healthy lifestyle and follow the prescribed treatment plan to improve your chances of approval.

Tips for Securing Life Insurance Approval

Work with an Independent Agent: Consulting an independent insurance agent who specializes in high-risk cases can significantly improve your chances of obtaining life insurance coverage. They have in-depth knowledge of various insurance providers and can guide you through the application process, helping you find the best policy that suits your needs.

Provide Comprehensive Medical Information: Ensure that you provide accurate and complete medical information during the application process to facilitate the underwriting process. Include details about your heart attack, any subsequent medical treatments or interventions, current medications, and follow-up care. The more detailed and transparent you are about your medical history, the better equipped the insurance company will be to evaluate your application.

Maintain a Healthy Lifestyle: Adopting a healthy lifestyle can positively impact your chances of securing life insurance approval. Engage in regular exercise, follow a balanced diet, and manage stress effectively. It is also crucial to strictly adhere to your prescribed medications and attend regular check-ups with your healthcare provider. These measures demonstrate your commitment to maintaining good overall health.

Quit Smoking: Smoking is a significant risk factor for cardiovascular diseases, including heart attacks. If you are a smoker, quitting smoking can greatly improve your chances of obtaining life insurance coverage after a heart attack. Insurance providers consider non-smokers as lower risk applicants and may offer more favorable premium rates.

Consider a Waiting Period: If you are unable to secure life insurance immediately after a heart attack, consider waiting until you have demonstrated a stable health condition for a specific period. During this time, focus on improving your overall health, following your healthcare provider’s recommendations, and maintaining a good track record of medical check-ups. This waiting period can strengthen your application and increase the likelihood of approval.

Conclusion…

Obtaining life insurance after experiencing a myocardial infarction may seem challenging, but it is not impossible. Insurance providers evaluate several factors, including the time since the heart attack, medical records, and your current health condition. By working closely with an independent insurance agent, providing comprehensive medical information, maintaining a healthy lifestyle, and considering the different types of life insurance policies available, you can enhance your chances of securing life insurance coverage. Remember, each insurance provider has its own underwriting guidelines, so it is crucial to explore multiple options and compare policies before making a decision. With the right approach and perseverance, you can protect your loved ones’ financial future and gain peace of mind despite your medical history.