In this article, we will explore the factors that life insurance companies consider when assessing applications from individuals who have recovered from Legionnaire’s disease. By understanding these factors, you can increase your chances of obtaining life insurance coverage that meets your needs.

Understanding Legionnaire’s Disease

Legionnaire’s disease is typically contracted by inhaling small droplets of water that contain the Legionella bacteria. This can occur through contaminated water vapor, such as from hot tubs, showers, or air conditioning systems. In rare cases, it can also be contracted by aspirating contaminated water, such as accidentally inhaling water while drinking.

Symptoms:

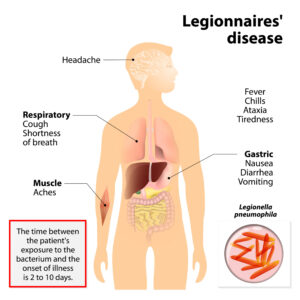

The symptoms of Legionnaire’s disease are similar to other types of pneumonia and can range from mild to severe. The most common symptoms include:

- High fever

- Cough, which may produce mucus or blood

- Shortness of breath or difficulty breathing

- Chest pain

- Fatigue

- Muscle aches

- Headaches

- Gastrointestinal symptoms, such as nausea, vomiting, and diarrhea

It is important to note that not everyone who is exposed to the Legionella bacteria will develop Legionnaire’s disease. Some individuals may have mild symptoms or no symptoms at all.

Treatment:

Prompt medical treatment is crucial for individuals diagnosed with Legionnaire’s disease. Antibiotics, such as fluoroquinolones or macrolides, are commonly prescribed to combat the infection. The specific antibiotic and duration of treatment will depend on the severity of the illness and the individual’s overall health. In severe cases, hospitalization may be required to provide intravenous antibiotics and supportive care, such as oxygen therapy.

Worst Case Scenario:

In rare instances, Legionnaire’s disease can lead to severe complications, especially in individuals with weakened immune systems or underlying health conditions. The worst-case scenario may involve:

- Acute Respiratory Distress Syndrome (ARDS): This is a life-threatening condition where the lungs fail to provide enough oxygen to the body’s organs, potentially leading to multiple organ failure.

- Septic Shock: Legionnaire’s disease can cause a severe infection that overwhelms the body’s immune system, leading to septic shock. This condition is characterized by extremely low blood pressure, organ failure, and a high risk of mortality.

- Organ Damage: In some cases, Legionnaire’s disease can cause damage to organs such as the kidneys or liver, resulting in long-term health complications.

It’s important to note that with early diagnosis and appropriate medical intervention, the prognosis for individuals with Legionnaire’s disease is generally favorable. Prompt treatment can help prevent severe complications and improve the chances of a full recovery.

Impact of Legionnaire’s Disease on Life Insurance Applications

The impact of Legionnaire’s disease on a life insurance application can vary depending on the severity of the illness and the presence of any complications. While individuals with mild cases and few complications may be eligible for preferred rates, others will be assessed on a case-by-case basis.

Insurance companies carefully evaluate the health risks associated with an applicant’s medical history, including any history of Legionnaire’s disease. Factors that influence the impact on life insurance applications include:

- Severity of the Illness: Insurance underwriters consider the severity of the Legionnaire’s disease and whether it required hospitalization or intensive medical intervention. Severe cases may raise concerns for insurance companies, potentially affecting the approval process.

- Complications and Long-Term Effects: The presence of complications or long-term effects resulting from Legionnaire’s disease can impact life insurance applications. Conditions such as chronic lung problems, organ damage, or respiratory issues may lead to higher premiums or limited coverage.

- Time Since Recovery: The length of time since an individual has recovered from Legionnaire’s disease is also taken into consideration. The longer the recovery period without relapses or significant health issues, the higher the chances of obtaining favorable rates or coverage.

- Medical Follow-up and Compliance: Consistent medical follow-up and adherence to prescribed treatments, medications, and preventive measures demonstrate responsible health management. Demonstrating ongoing care and compliance can improve the chances of obtaining life insurance approval.

- Overall Health and Lifestyle Factors: Insurance companies assess an applicant’s overall health and lifestyle habits. Factors such as smoking, obesity, or pre-existing medical conditions can affect the approval process, alongside the history of Legionnaire’s disease.

That said, what you’re generally going to find is that in cases where an applicant has experienced mild Legionnaire’s disease with no long-term complications, they may be eligible for preferred rates similar to individuals with no significant health issues. However, for individuals with a history of severe cases or complications, the approval process may involve more scrutiny and a case-by-case assessment.

Improving Your Approval Chances

While there are factors that may affect your life insurance approval, there are steps you can take to improve your chances of obtaining coverage:

- Maintain good overall health: Leading a healthy lifestyle, including regular exercise, a balanced diet, and avoiding tobacco and excessive alcohol consumption, can positively impact your approval chances.

- Follow your doctor’s recommendations: Adhering to your healthcare provider’s instructions, taking prescribed medications, and attending regular check-ups will demonstrate your commitment to managing your health.

- Build a strong medical record: Keep thorough documentation of your recovery process, including medical reports, test results, and treatment summaries. Having a comprehensive medical record can provide valuable evidence of your health status and help support your application.

- Work with an experienced insurance professional: An insurance agent or broker who specializes in high-risk cases can guide you through the application process, assist in finding insurance companies that are more likely to approve your application, and help you present your case effectively.

Conclusion…

Securing life insurance coverage is important for everyone, including individuals who have recovered from Legionnaire’s disease. While there may be additional considerations and challenges in the application process, it is still possible to obtain life insurance approval. By understanding the factors that insurance companies evaluate, maintaining good health, and seeking professional guidance, you can increase your chances of finding the right coverage that meets your needs.

Remember, honesty and transparency throughout the application process are crucial. Protecting your loved ones’ financial future is a worthy endeavor, and life insurance can provide the peace of mind you seek.

Frequently Asked Questions

Can I get life insurance if I have a history of Legionnaire’s disease?

Yes, it is possible to obtain life insurance even with a history of Legionnaire’s disease. However, the approval and terms of coverage will depend on factors such as the severity of the illness, presence of complications, time since recovery, and overall health status. Each case is evaluated individually by insurance companies.

Will having Legionnaire’s disease affect my life insurance premiums?

The impact on premiums will vary depending on the severity of the illness and any associated complications. Mild cases with no long-term effects may not significantly affect premiums. However, more severe cases or the presence of complications can lead to higher premiums or limited coverage.

How long should I wait after recovering from Legionnaire’s disease before applying for life insurance?

The length of time you should wait after recovering from Legionnaire’s disease before applying for life insurance varies depending on the insurance company. Generally, a longer period of stability and good health after recovery improves your chances of obtaining favorable rates. It is recommended to discuss the timing with an insurance professional who can guide you based on your specific situation.

Should I disclose my history of Legionnaire’s disease when applying for life insurance?

Yes, it is crucial to provide accurate and comprehensive information about your medical history, including any past or current experience with Legionnaire’s disease. Failure to disclose this information can lead to complications, including policy denial or cancellation. Honesty and transparency throughout the application process are essential.

Will I need to provide medical records or undergo medical tests when applying for life insurance with a history of Legionnaire’s disease?

Yes, insurance companies will typically request your medical records, including information about your Legionnaire’s disease diagnosis and recovery. They may also require additional medical tests or evaluations, such as pulmonary function tests, to assess your current health status and any potential long-term effects of the disease.

Is it possible to obtain life insurance if I have complications or long-term effects from Legionnaire’s disease?

Yes, it is possible to obtain life insurance with complications or long-term effects from Legionnaire’s disease. However, the approval and terms of coverage will depend on the severity and stability of the complications, as well as your overall health status. Insurance companies will assess each case individually to determine the appropriate rates and coverage.

Can I improve my chances of getting life insurance with a history of Legionnaire’s disease?

Yes, there are steps you can take to improve your chances of obtaining life insurance coverage. These include maintaining good overall health, following your doctor’s recommendations, having regular check-ups, building a strong medical record, and working with an experienced insurance professional who can navigate the application process and present your case effectively.

Remember, every insurance company has its own underwriting guidelines, so it is important to consult with an insurance professional who can provide personalized guidance based on your specific situation.