In this article, we will explore the specific considerations for individuals with hydrocephalus seeking life insurance coverage. We will discuss the impact of hydrocephalus on the insurance application process, potential obstacles, and strategies to improve the chances of obtaining life insurance coverage.

Understanding Hydrocephalus

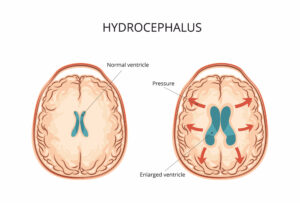

Hydrocephalus, also known as “water on the brain,” is a condition characterized by an excessive accumulation of cerebrospinal fluid in the ventricles (fluid-filled spaces) of the brain. This accumulation causes the ventricles to expand, resulting in increased pressure on the brain tissue. The excess fluid disrupts normal brain function and can lead to various neurological symptoms.

Causes of Hydrocephalus:

Hydrocephalus can have multiple causes, including: a. Congenital Hydrocephalus: It occurs when a baby is born with the condition due to abnormalities in the development of the central nervous system, such as genetic factors or infections during pregnancy. b. Acquired Hydrocephalus: It can develop later in life due to factors such as head trauma, brain tumors, infections (e.g., meningitis), bleeding within the brain (e.g., intraventricular hemorrhage), or complications of certain medical conditions (e.g., spina bifida).

Symptoms of Hydrocephalus:

The symptoms of hydrocephalus can vary depending on the age of onset and the rate of fluid accumulation. In infants, symptoms may include an enlarged head, bulging fontanelles (soft spots on the baby’s skull), seizures, irritability, poor feeding, and delayed development. In older children and adults, symptoms may include headache, nausea, vomiting, blurred vision, difficulty in balance and coordination, cognitive difficulties, and changes in personality or behavior.

Treatment Options for Hydrocephalus:

The primary goal of treating hydrocephalus is to relieve the excess pressure on the brain and prevent further damage. The treatment approach depends on the underlying cause and may involve:

- Shunt Placement: A shunt is a device that diverts the excess cerebrospinal fluid from the brain to another part of the body, such as the abdomen or the heart. This helps regulate the fluid balance and relieves the pressure on the brain.

- Endoscopic Third Ventriculostomy (ETV): In some cases, an alternative surgical procedure called ETV may be performed. It involves creating a small hole in the floor of the third ventricle to allow CSF to flow out of the brain, bypassing the need for a shunt.

- Medications: In certain types of hydrocephalus, medications may be prescribed to reduce CSF production or promote its absorption, though this is less common.

Worst-Case Scenario:

Complications and Long-Term Outlook (300 words) While timely and appropriate treatment can often manage hydrocephalus effectively, complications can arise in severe or untreated cases. The worst-case scenario may involve:

- Brain Damage: If left untreated, the increased pressure on the brain can lead to irreversible damage, affecting cognitive function, motor skills, and overall neurological health.

- Intellectual and Developmental Disabilities: Hydrocephalus can interfere with normal brain development, leading to intellectual disabilities, learning difficulties, and delays in reaching developmental milestones.

- Vision Problems: Hydrocephalus can cause optic nerve damage and result in vision impairment or blindness if left untreated or if the pressure on the optic nerves persists for an extended period.

- Epilepsy: Some individuals with hydrocephalus may develop epilepsy, a neurological disorder characterized by recurrent seizures.

- Cognitive and Behavioral Issues: Hydrocephalus can impact cognitive abilities, memory, attention, and executive functioning. It may also contribute to behavioral changes, such as mood swings, irritability, and impulsivity.

- Physical Impairments: In severe cases, hydrocephalus can lead to motor impairments, including muscle weakness, coordination difficulties, and problems with balance and gait.

It is important to note that the long-term outlook for individuals with hydrocephalus can vary significantly depending on the severity of the condition, the underlying cause, and the effectiveness of treatment. Early diagnosis and intervention greatly improve the chances of managing hydrocephalus and minimizing potential complications.

Impact on One’s life insurance application

Impact on Life Insurance Application: Hydrocephalus can have significant implications for life insurance applications. The impact may vary depending on whether the condition is congenital or acquired later in life.

Congenital Hydrocephalus: If hydrocephalus is present from birth (congenital), it can be more challenging to qualify for a traditional life insurance policy. Insurance companies typically consider congenital conditions as higher risks, and coverage will likely be denied or limited due to the potential complications associated with hydrocephalus.

However, there are alternative options available for individuals with congenital hydrocephalus, such as guaranteed issue life insurance policies. These policies do not require medical underwriting and provide coverage without considering pre-existing conditions. Keep in mind that guaranteed issue policies often come with higher premiums and lower coverage amounts.

Acquired Hydrocephalus: If hydrocephalus develops later in life due to trauma, infection, or other factors, the impact on life insurance applications may differ. Insurance companies may consider offering coverage, but it is likely to come with substandard or table ratings. This means that the premiums for the policy will be higher compared to individuals without hydrocephalus, reflecting the increased risk.

Tips for finding coverage

When seeking life insurance coverage with hydrocephalus, there are several tips that can improve your chances of obtaining a policy. While the process may be more challenging, following these strategies can help you navigate the application process:

- Work with an Experienced Insurance Professional: Seek the assistance of an insurance agent or broker who specializes in high-risk cases and has experience working with individuals with hydrocephalus. They can guide you through the application process, understand your specific needs, and help you find insurers that are more likely to offer coverage.

- Be Transparent and Disclose Information: It is crucial to provide full and honest disclosure of your medical history, including your hydrocephalus diagnosis, treatment, and any associated complications. Failure to disclose relevant information can result in denial of coverage or potential claims being contested in the future. Providing accurate and detailed information is essential to ensure a fair underwriting process.

- Gather Comprehensive Medical Records: Collect and organize all relevant medical records, including diagnostic tests, treatment history, and physician reports. The more comprehensive and up-to-date your medical documentation, the better the insurers can assess your condition and the associated risks. Ensure that you have complete records that demonstrate your diligent management of hydrocephalus.

- Highlight Stable Symptoms and Treatment Compliance: If your hydrocephalus is stable and well-controlled, emphasize this aspect during the application process. Provide medical records that indicate consistent symptom stability over a significant period. Demonstrate your compliance with treatment plans, such as regular medical check-ups, medications, and surgeries. This can help showcase responsible management of the condition and potentially mitigate the concerns of insurers.

- Improve Overall Health and Lifestyle: Maintain a healthy lifestyle by engaging in regular exercise, adopting a balanced diet, and avoiding tobacco and excessive alcohol use. Demonstrating a commitment to overall well-being can positively influence insurers and showcase your proactive efforts to manage your health effectively.

- Explore Alternative Insurance Options: If traditional life insurance policies are challenging to secure, consider alternative options such as guaranteed issue life insurance or modified benefit plans. While these options may come with higher premiums and lower coverage amounts, they provide an opportunity to obtain coverage without medical underwriting or with modified terms.

- Be Prepared for Higher Premiums: Due to the increased risk associated with hydrocephalus, it is likely that your life insurance premiums will be higher compared to individuals without the condition. Be prepared for this financial consideration and factor it into your budget.

Remember, the insurance landscape is complex, and each insurer has its own underwriting guidelines. By working with a knowledgeable insurance professional and following these tips, you can improve your chances of obtaining life insurance coverage that suits your needs and provides financial security for your loved ones.