Since most life insurance companies are going to view convulsions and seizures the same way during underwriting, we’ve choose to include these two symptons/conditions under the umbrella term “Epilepsy” so that things don’t get too complicated.

After all, we’re not doctors, we’re just a bunch of life insurance agents trying to simplify the process of getting insured after you’ve been diagnosed with a pre-existing medical condition like those that can cause one to suffer from a seizure. A condition such as Epilepsy.

And seeing how Epilepsy, is probably one of the more serious conditions that could cause someone to suffer from a seizure it only makes sense to make it the primary focus of this article.

Understanding Epilepsy

Epilepsy is a neurological disorder that affects the brain and causes recurring seizures or convulsions. It’s a chronic condition that affects people of all ages and can have a significant impact on their quality of life.

Causes of Epilepsy:

The exact cause of epilepsy is not always known, but some factors that may contribute to the development of the condition include:

- Genetic factors: Some types of epilepsy may be hereditary and run in families.

- Head injuries: Trauma to the head can cause damage to the brain and trigger seizures.

- Brain infections: Certain infections, such as meningitis or encephalitis, can lead to epilepsy.

- Stroke: A stroke can cause damage to the brain and increase the risk of seizures.

- Brain tumors: A tumor in the brain can interfere with normal brain function and cause seizures.

Symptoms of Epilepsy:

The primary symptom of epilepsy is recurrent seizures. These seizures can take many forms, including:

- Convulsions: Involuntary movements of the body, such as jerking, shaking, or twitching.

- Staring spells: Brief periods of staring into space without being aware of surroundings.

- Loss of consciousness: Temporary loss of consciousness or awareness.

- Confusion: Difficulty speaking, thinking, or understanding.

- Mood changes: Sudden changes in mood or behavior.

Treatments for Epilepsy:

While there is no cure for epilepsy, there are several treatments that can help manage the condition and reduce the frequency and severity of seizures. These treatments include:

- Medications: Anti-epileptic drugs (AEDs) are the most common treatment for epilepsy. They work by reducing the activity of neurons in the brain that trigger seizures.

- Surgery: In some cases, surgery may be recommended to remove a part of the brain that is causing seizures.

- Vagus nerve stimulation (VNS): This treatment involves implanting a device that sends electrical signals to the brain to reduce the frequency and severity of seizures.

- Ketogenic diet: A high-fat, low-carbohydrate diet that can help reduce seizures in some people with epilepsy.

Worst Case Scenario:

In some cases, epilepsy can be life-threatening. The most severe complication of epilepsy is status epilepticus, which is a prolonged seizure lasting more than five minutes or multiple seizures without recovery in between. Status epilepticus can cause brain damage, respiratory failure, and even death if not treated promptly. Other complications of epilepsy include injuries from falls or accidents during seizures, depression and anxiety, and social isolation due to the stigma associated with the condition.

What Do Life Insurance Companies Look for When Assessing Applicants with Epilepsy?

When assessing applicants with epilepsy, life insurance companies typically look at several factors to determine their risk level and eligibility for coverage. These factors may include:

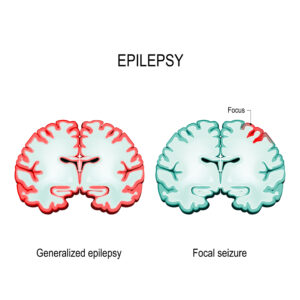

Type and severity of epilepsy: The type and severity of epilepsy can impact the risk of complications and the likelihood of future seizures. Insurance companies will typically review medical records and test results to evaluate the severity of the condition.

Frequency and duration of seizures: Insurance companies may ask about the frequency and duration of seizures to assess the level of risk associated with the condition.

Treatment plan: A comprehensive treatment plan that includes medication, lifestyle modifications, and other interventions can help manage epilepsy and reduce the risk of complications. Insurance companies may ask about the treatment plan and adherence to medication to evaluate the level of control over the condition.

Overall health: Insurance companies will also consider the applicant’s overall health, including any other medical conditions or risk factors that could increase the risk of complications or mortality.

Age: Age is an important factor in determining life insurance premiums and eligibility. Insurance companies may consider the age of onset of epilepsy and the applicant’s current age to assess the risk level.

Occupation and lifestyle: Certain occupations or lifestyle factors, such as high-risk activities or drug/alcohol use, can increase the risk of seizures and complications. Insurance companies may ask about these factors to evaluate the level of risk associated with the applicant’s lifestyle.

Based on these factors, insurance companies may offer coverage at standard rates, substandard rates (higher premiums), or deny coverage altogether.

Applicants with well-managed epilepsy and a comprehensive treatment plan may be more likely to be approved for coverage at preferred rates, while those with more severe or uncontrolled epilepsy may have difficulty obtaining coverage or may need to consider guaranteed issue policies with higher premiums and lower coverage amounts.

How to Increase Your Chances of Approval

If you have epilepsy and are applying for life insurance, there are several things you can do to increase your chances of approval:

Work with an Independent Agent:

An independent insurance agent can help you navigate the underwriting process and find a life insurance company that’s willing to work with you. Independent agents work with multiple insurance companies, so they have a broader range of options to choose from.

Be Honest About Your Condition:

It’s essential to be honest about your epilepsy and provide as much information as possible to the life insurance company. This includes your medical history, treatment plan, and any other relevant details.

Follow Your Treatment Plan:

Following your doctor’s advice and taking your medication as prescribed can show the life insurance company that you’re managing your condition effectively.

Maintain a Healthy Lifestyle:

Maintaining a healthy lifestyle can also help you increase your chances of approval. This includes eating a healthy diet, exercising regularly, and avoiding smoking and excessive alcohol consumption.

Consider a Guaranteed Issue Life Insurance Policy:

If you’re having difficulty obtaining life insurance due to your epilepsy, a guaranteed issue life insurance policy may be an option. Guaranteed issue policies don’t require a medical exam or any health questions, making them easier to qualify for. However, they usually come with higher premiums and lower coverage amounts than traditional life insurance policies.

What to Expect During the Underwriting Process

The underwriting process for life insurance with epilepsy is similar to the process for any other medical condition. Here’s what you can expect:

- Application The first step is to complete a life insurance application. You’ll need to provide information about your medical history, including your epilepsy and any other health conditions you have.

- Medical Exam Depending on the insurance company and the amount of coverage you’re applying for, you may be required to undergo a medical exam. The exam will typically include a physical exam, blood work, and urine tests.

- Medical Records The insurance company will request your medical records from your doctor or other healthcare providers. They’ll review your records to assess your risk level.

- Underwriting Decision Based on the information you provide on your application, the results of your medical exam, and your medical records, the insurance company will make an underwriting decision. They’ll determine if they’re willing to offer you coverage, and if so, what your premiums will be.

Final thoughts:

Having epilepsy doesn’t mean you can’t obtain life insurance coverage. While it may be more challenging to get approved, there are steps you can take to increase your chances of approval. Working with an independent agent, being honest about your condition, following your treatment plan, maintaining a healthy lifestyle, and considering a guaranteed issue policy can all help you get the coverage you need. Remember to be patient and persistent during the underwriting process, as it may take some time to find the right policy for you.

Frequently Asked Questions

Can I get life insurance if I have epilepsy?

Yes, it is possible to get life insurance if you have epilepsy. However, the type and severity of epilepsy and your overall health may impact your eligibility and premiums.

Will my premiums be higher if I have epilepsy?

It is possible that your premiums may be higher if you have epilepsy, especially if your condition is severe or uncontrolled. Insurance companies typically assess the risk level associated with the condition and adjust premiums accordingly.

What information do I need to provide when applying for life insurance with epilepsy?

When applying for life insurance with epilepsy, you will typically need to provide information about your medical history, treatment plan, and any medications you are taking. You may also be asked about the frequency and duration of seizures, as well as any lifestyle factors or other medical conditions that could impact your risk level.

Can I get life insurance if I have a history of seizures?

It is possible to get life insurance if you have a history of seizures. However, the type, frequency, and duration of seizures will be evaluated when assessing your eligibility and premiums.

What if I am denied coverage for life insurance due to epilepsy?

If you are denied coverage for life insurance due to epilepsy, you may want to consider guaranteed issue policies, which do not require a medical exam or health questionnaire. However, these policies typically have higher premiums and lower coverage amounts.

Can I get life insurance if I am currently experiencing seizures?

It may be difficult to obtain life insurance if you are currently experiencing seizures. Insurance companies typically prefer applicants who have been seizure-free for a certain period of time and are actively managing their condition with a comprehensive treatment plan.

Can I apply for life insurance if I am taking medication for my epilepsy?

Yes, you can still apply for life insurance if you are taking medication for your epilepsy. However, the insurance company may ask for details about your medication, including the name of the medication, dosage, and how long you have been taking it. This information will help them assess your overall health and manage any potential risks associated with your condition.

How long do I need to be seizure-free before I can apply for life insurance?

The length of time you need to be seizure-free before you can apply for life insurance varies depending on the insurance company and its specific guidelines. Typically, insurance companies prefer applicants who have been seizure-free for at least a year, although some may require longer periods of seizure-free time before approving coverage.

What can I do to improve my overall health and increase my chances of approval? Improving your overall health can increase your chances of approval for life insurance, especially if you have a pre-existing condition like epilepsy. Some steps you can take to improve your health include:

- Following a healthy diet and exercise plan

- Maintaining a healthy weight

- Quitting smoking if you are a smoker

- Reducing alcohol consumption

- Taking prescribed medications as directed

- Managing stress through relaxation techniques, meditation, or counseling

- Staying up to date on medical appointments and tests