If you have diverticulitis, you may be concerned about how it will affect your ability to obtain life insurance. While it is true that some insurance companies may be hesitant to approve coverage for individuals with this condition, it is still possible to get life insurance coverage with diverticulitis.

In this article, we will discuss what you need to know about life insurance approvals and diverticulitis.

Understanding Diverticulitis

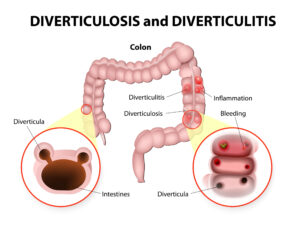

Diverticulitis is a condition where small pockets or sacs (diverticula) that form in the wall of the large intestine become inflamed or infected. This condition is more common in older adults and can be chronic.

Causes:

The exact cause of diverticulitis is not well understood, but it is believed to be related to a combination of factors, including genetics, diet, and lifestyle. The condition is more common in people who consume a low-fiber diet, as this can lead to constipation and increased pressure on the colon.

Symptoms:

The symptoms of diverticulitis can vary from mild to severe and may include abdominal pain and cramping, bloating and gas, constipation or diarrhea, nausea and vomiting, fever and chills, and loss of appetite. In severe cases, diverticulitis can lead to complications such as abscesses, perforations, and fistulas.

Treatment:

Treatment for diverticulitis depends on the severity of the condition. In mild cases, treatment may involve a high-fiber diet and over-the-counter medications for pain and discomfort. In more severe cases, antibiotics may be prescribed, and hospitalization may be necessary. Surgery may also be required in cases of severe complications.

Worst case scenario:

In rare cases, untreated or severe diverticulitis can lead to life-threatening complications, such as peritonitis (inflammation of the lining of the abdominal cavity), sepsis (a potentially life-threatening infection), and bowel obstruction. It is essential to seek medical attention if you experience severe abdominal pain or other symptoms of diverticulitis, especially if you have a history of the condition.

Life Insurance Approvals and Diverticulitis

If you have diverticulitis, you may be wondering if you can still obtain life insurance coverage. The answer is yes – it is possible to get life insurance coverage with diverticulitis. However, the process may be more challenging, and you may need to provide more detailed information about your condition.

When you apply for life insurance coverage, the insurance company will typically ask you to complete a health questionnaire and undergo a medical exam. The health questionnaire will ask you to provide detailed information about your medical history, including any diagnoses, medications, and treatments. So, if you have diverticulitis, you will need to disclose this on your health questionnaire.

The insurance company will then review your application and may ask for additional information, such as medical records from your doctor. They may also request that you undergo additional medical tests, such as a colonoscopy or CT scan, to assess the severity of your condition.

Then based on the information you provided, the insurance company will determine your risk level and decide whether to approve your application. Now, what we have found to be true most often is that if you have mild diverticulitis that is well-managed with medication and lifestyle changes, you may be able to obtain coverage at a preferred rate.

However, if you have severe diverticulitis or have experienced complications, such as hospitalization or surgery, you may be considered a higher risk and may be offered coverage at a higher rate or with exclusions.

Tips for Obtaining Life Insurance Coverage with Diverticulitis

If you have diverticulitis and are applying for life insurance coverage, there are several things you can do to increase your chances of approval and get the best possible rate:

Be honest and upfront about your condition.

Disclose your diverticulitis diagnosis on your health questionnaire and provide as much detail as possible about your medical history and treatment.

Work with a broker who specializes in high-risk cases.

Insurance brokers have access to a wide range of insurance providers and can help you find a company that is willing to provide coverage despite your condition.

Maintain a healthy lifestyle.

If you have diverticulitis, it is important to follow a high-fiber diet and avoid foods that can trigger symptoms. You should also exercise regularly and maintain a healthy weight, as this can help reduce your risk of complications.

Provide as much documentation as possible.

The more information you can provide about your condition, the better. This may include medical records, test results, and letters from your doctor.

Be patient.

The life insurance approval process can be lengthy, especially if you have a pre-existing condition. Be prepared to provide additional information or undergo additional tests, and don’t be discouraged if the process takes longer than expected.

For those that can’t qualify for a traditional life insurance policy

For individuals who cannot qualify for a traditional life insurance policy due to their health condition or other factors, there are still options available to provide protection for their loved ones. Two of these options are guaranteed issue life insurance and accidental death insurance.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of life insurance policy that is designed for individuals who have difficulty obtaining coverage through traditional means, such as due to a pre-existing health condition. With guaranteed issue life insurance, there are no medical exams or health questions required to qualify for coverage. As long as the applicant meets the age requirements and resides in the coverage area, they are guaranteed to be approved for coverage.

While guaranteed issue life insurance may seem like an attractive option for individuals who cannot qualify for traditional life insurance, there are some important considerations to keep in mind. One significant drawback of this type of policy is that the coverage amount is often limited, typically ranging from $5,000 to $25,000. The premiums for guaranteed issue policies are also generally higher than those for traditional life insurance policies, as the insurance company is taking on a greater risk by insuring individuals without a complete medical history.

Accidental Death Insurance

Accidental death insurance is a type of life insurance policy that pays a benefit to the policy’s beneficiaries in the event of the insured’s death due to an accident. Unlike traditional life insurance policies, accidental death policies do not typically require a medical exam or health questionnaire. Instead, they focus solely on the risk of accidental death.

Accidental death insurance policies can be an affordable option for individuals who cannot qualify for traditional life insurance due to their health or lifestyle. However, it is important to note that accidental death policies only provide coverage for accidental death, and not for death due to natural causes or illness. Additionally, accidental death policies may have exclusions for certain activities or causes of death, so it is important to read the policy carefully to understand what is covered and what is not.

Conclusion…

If you have diverticulitis, obtaining life insurance coverage may require more effort and documentation, but it is still possible. By being honest about your condition, working with a knowledgeable broker, maintaining a healthy lifestyle, and providing as much documentation as possible, you can increase your chances of approval and get the best possible rate. Remember to be patient and don’t give up – with the right approach, you can obtain the life insurance coverage you need to protect yourself and your loved ones.

Frequently asked questions

Can I get life insurance coverage if I have a pre-existing condition such as diverticulitis?

Yes, it is possible to obtain life insurance coverage if you have a pre-existing condition such as diverticulitis. However, the approval process may require more effort and documentation, and the cost of coverage may be higher.

What is guaranteed issue life insurance?

A: Guaranteed issue life insurance is a type of life insurance policy that is designed for individuals who have difficulty obtaining coverage through traditional means, such as due to a pre-existing health condition. With guaranteed issue life insurance, there are no medical exams or health questions required to qualify for coverage.

What is accidental death insurance?

Accidental death insurance is a type of life insurance policy that pays a benefit to the policy’s beneficiaries in the event of the insured’s death due to an accident. Unlike traditional life insurance policies, accidental death policies do not typically require a medical exam or health questionnaire.

How much life insurance coverage do I need?

The amount of life insurance coverage you need will depend on your individual circumstances, such as your income, debts, and number of dependents. A general rule of thumb is to have coverage that is 10 to 12 times your annual income.

How can I lower the cost of my life insurance premiums?

There are several ways to lower the cost of your life insurance premiums, such as maintaining a healthy lifestyle, quitting smoking, choosing a term life insurance policy instead of a permanent policy, and shopping around for the best rates from different insurance providers.

How long does the life insurance application process take?

The life insurance application process can vary depending on the insurance provider and the type of policy you are applying for. Typically, the process can take anywhere from a few days to several weeks. The time it takes to process your application can be influenced by factors such as your health condition, the amount of coverage you are seeking, and whether or not a medical exam is required.

What happens if I miss a premium payment?

If you miss a premium payment on your life insurance policy, you may have a grace period to make the payment without the policy lapsing. The length of the grace period can vary depending on the insurance provider and the type of policy you have. If you miss the grace period, your policy may lapse, which means you will no longer have coverage.

Can I cancel my life insurance policy?

Yes, you can cancel your life insurance policy at any time. However, there may be fees or penalties for canceling your policy, especially if you cancel it early in the policy term. Additionally, if you cancel your policy, you will no longer have coverage and your beneficiaries will not receive a payout in the event of your death.

Do I need to have a medical exam to obtain life insurance coverage?

It depends on the insurance provider and the type of policy you are applying for. Some policies, such as guaranteed issue life insurance and accidental death insurance, do not require a medical exam. However, traditional life insurance policies may require a medical exam to determine your health status and risk level.