Life insurance is an important financial tool that can provide peace of mind and financial security for individuals and their families. However, obtaining life insurance can be challenging for those with pre-existing medical conditions, such as Cushing’s Disease. In this article, we will explore what Cushing’s Disease is, how it affects life insurance approvals, and what steps you can take to improve your chances of being approved for life insurance coverage.

What is Cushing’s Disease?

Cushing’s Disease is a rare endocrine disorder caused by an excess of cortisol in the body. Cortisol is a hormone that is released by the adrenal glands in response to stress. It plays an important role in regulating various bodily functions, including blood sugar levels, blood pressure, and immune system responses.

Causes:

The most common cause of Cushing’s Disease is a tumor on the pituitary gland, a small gland located at the base of the brain. The tumor produces adrenocorticotropic hormone (ACTH), which stimulates the adrenal glands to produce more cortisol than the body needs. In rare cases, Cushing’s Disease can be caused by a tumor on the adrenal gland itself or by tumors elsewhere in the body that produce ACTH.

Symptoms:

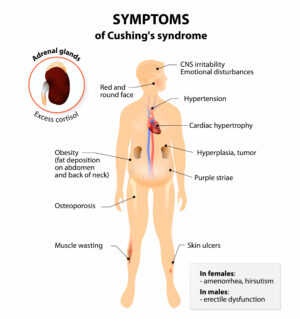

The symptoms of Cushing’s Disease can vary widely from person to person, but may include:

- Weight gain, particularly around the midsection and upper back

- Skin changes, such as thinning, bruising, and acne

- Mood swings, depression, or anxiety

- High blood pressure

- Muscle weakness and loss of muscle mass

- Excessive hair growth in women

- Irregular or absent menstrual periods in women

- Osteoporosis or bone fractures

- Increased risk of infections

- Diabetes or high blood sugar

Treatments:

The treatment for Cushing’s Disease depends on the underlying cause of the excess cortisol production. In some cases, surgery may be necessary to remove a tumor on the pituitary gland or adrenal gland. Radiation therapy or medications that block the production of cortisol may also be used. Lifestyle changes, such as exercise and healthy eating, can also help manage symptoms and improve overall health.

Worst case scenario:

If left untreated, Cushing’s Disease can lead to serious complications, such as:

- Type 2 diabetes

- High blood pressure and cardiovascular disease

- Increased risk of infections

- Osteoporosis and bone fractures

- Mental health issues, such as depression and anxiety

- Weakened immune system

- Increased risk of cancer

In rare cases, Cushing’s Disease can be fatal if it is not treated or managed properly. It is important for individuals with Cushing’s Disease to work closely with their healthcare team to manage their symptoms and reduce their risk of complications.

How does Cushing’s Disease affect life insurance approvals?

Life insurance underwriters use a variety of factors to determine the risk of insuring an individual, including their age, gender, occupation, and health history. For those with pre-existing medical conditions, such as Cushing’s Disease, the underwriting process can be more complicated.

When evaluating a life insurance application, underwriters will review an applicant’s medical records and may require additional medical exams or tests. For individuals with Cushing’s Disease, underwriters will be particularly interested in the severity of the condition, how it is being managed, and any associated health risks.

In general, individuals with well-managed Cushing’s Disease who are following their treatment plan and have no other significant health issues may be able to obtain life insurance coverage at a preferred rate.

However, those with more severe cases of Cushing’s Disease, or who have other health issues, may face more difficulty in obtaining coverage or may be charged higher premiums.

What steps can you take to improve your chances of being approved for life insurance coverage with Cushing’s Disease?

Be upfront about your condition

It is important to be honest and upfront about your Cushing’s Disease when applying for life insurance. Underwriters will review your medical records, so it is better to disclose your condition and any related health concerns upfront rather than risk having your application denied later on.

Work with an experienced insurance agent

An experienced insurance agent can help guide you through the application process and work with underwriters to present your case in the best possible light. They can also help you find insurance companies that specialize in providing coverage to those with pre-existing medical conditions.

Follow your treatment plan

Following your treatment plan and keeping up with regular medical appointments can help demonstrate to underwriters that you are actively managing your Cushing’s Disease and taking steps to stay healthy. This can improve your chances of being approved for life insurance coverage and may also result in lower premiums.

Improve your overall health

Underwriters will also consider your overall health when evaluating your life insurance application. Taking steps to improve your overall health, such as quitting smoking, losing weight, and managing any other health conditions, can help demonstrate that you are committed to staying healthy and reducing your risk of future health issues.

Consider a guaranteed issue life insurance policy

If you are unable to obtain traditional life insurance coverage due to your Cushing’s Disease, you may want to consider a guaranteed issue life insurance policy. These policies do not require a medical exam or any health questions and are typically available to individuals up to a certain age. However, they often have lower coverage amounts and higher premiums than traditional life insurance policies.

Closing thoughts…

Cushing’s Disease can make it more difficult to obtain life insurance coverage, but it is not impossible. By being upfront about your condition, working with an experienced insurance agent, following your treatment plan, improving your overall health, and considering alternative insurance options, you can improve your chances of being approved for coverage. Remember to have realistic expectations and be patient throughout the application process. With perseverance and the right support, you can obtain the life insurance coverage you need to provide financial security for you and your loved ones.

Frequently Asked Questions

Can I get life insurance if I have Cushing’s Disease?

Yes, it is possible to obtain life insurance coverage if you have Cushing’s Disease. However, it may be more difficult and you may need to pay higher premiums or accept lower coverage amounts.

What factors do life insurance companies consider when evaluating applications from individuals with Cushing’s Disease?

Life insurance companies consider a variety of factors when evaluating applications, including an individual’s age, gender, health history, current health status, and any associated health risks or complications.

What information do I need to provide when applying for life insurance with Cushing’s Disease?

When applying for life insurance with Cushing’s Disease, you will need to provide accurate and detailed information about your health history and current health status. This may include medical records, laboratory tests, and consultations with specialists.

Will having Cushing’s Disease impact the cost of my life insurance premiums?

Yes, having Cushing’s Disease may impact the cost of your life insurance premiums. Depending on the severity of your condition and associated health risks, you may need to pay higher premiums or accept lower coverage amounts.

What can I do to improve my chances of getting approved for life insurance with Cushing’s Disease?

To improve your chances of getting approved for life insurance with Cushing’s Disease, you should work with an experienced insurance agent, follow your treatment plan, improve your overall health, and consider alternative insurance options. It is also important to have realistic expectations and be patient throughout the application process.

Should I disclose my Cushing’s Disease to my life insurance company?

Yes, it is important to disclose your Cushing’s Disease to your life insurance company when applying for coverage. Providing accurate and detailed information about your health history and current health status will help ensure that you receive the appropriate coverage and that your premiums are properly calculated.

Can I still get life insurance if I have been declined in the past due to my Cushing’s Disease?

Yes, it is still possible to obtain life insurance coverage even if you have been declined in the past due to your Cushing’s Disease. You may need to work with an experienced insurance agent to explore alternative options and find a company that is willing to offer coverage.

Are there any specific types of life insurance policies that are better suited for individuals with Cushing’s Disease?

There are no specific types of life insurance policies that are better suited for individuals with Cushing’s Disease. However, some policies may be more flexible in terms of their underwriting and approval process, which may be beneficial for those with pre-existing medical conditions.

How can an insurance agent help me when applying for life insurance with Cushing’s Disease?

An experienced insurance agent can help you navigate the life insurance application process and find a company that is willing to offer coverage. They can also provide valuable advice and guidance on how to improve your chances of getting approved and how to manage your premiums.

What should I do if I am unable to obtain life insurance coverage due to my Cushing’s Disease?

If you are unable to obtain life insurance coverage due to your Cushing’s Disease, there are still options available to you. You may want to consider alternative insurance options, such as accidental death and dismemberment insurance or final expense insurance. Additionally, it is important to work with your healthcare providers to manage your condition and improve your overall health.