In this article, we will discuss how life insurance companies evaluate COPD and what you can do to increase your chances of getting approved for life insurance coverage.

Understanding COPD:

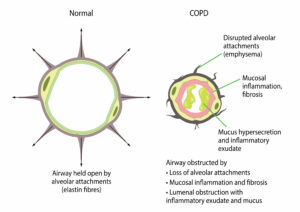

Chronic Obstructive Pulmonary Disease (COPD) is a chronic respiratory disease that affects the lungs and makes it difficult to breathe. COPD is a term used to describe a group of lung conditions that includes chronic bronchitis, emphysema, and refractory asthma. COPD is a progressive disease, meaning that it worsens over time.

Causes of COPD:

The primary cause of COPD is smoking, but exposure to pollutants, dust, and chemicals can also contribute to the development of the disease. Long-term exposure to secondhand smoke can also increase the risk of developing COPD. Genetic factors may also play a role in the development of COPD, although this is less common.

Symptoms of COPD:

COPD symptoms typically develop slowly over time and can include:

- Chronic cough: A cough that produces mucus that lasts for at least three months.

- Shortness of breath: Feeling breathless, especially during physical activity.

- Wheezing: A whistling sound when breathing.

- Tightness in the chest: A feeling of pressure or tightness in the chest.

- Fatigue: Feeling tired or weak.

- Unintentional weight loss: Losing weight without trying.

- Frequent respiratory infections: Developing frequent respiratory infections, such as bronchitis or pneumonia.

Treatment for COPD:

Although there is no cure for COPD, there are several treatment options that can help manage symptoms and improve quality of life. Treatment options for COPD include:

- Medications: Bronchodilators and corticosteroids can help open airways and reduce inflammation in the lungs.

- Oxygen therapy: Supplemental oxygen can help improve breathing and reduce shortness of breath.

- Pulmonary rehabilitation: A program that includes exercise, breathing techniques, and education on managing symptoms.

- Surgery: In severe cases, surgery may be an option to remove damaged lung tissue or to perform a lung transplant.

Worst Case Scenario:

In severe cases, COPD can lead to a number of complications, including:

- Respiratory failure: When the lungs can no longer function properly, and oxygen levels in the blood become dangerously low.

- Heart problems: COPD can lead to an increased risk of heart disease and heart failure.

- Lung cancer: People with COPD are at an increased risk of developing lung cancer.

- Depression and anxiety: COPD can affect a person’s quality of life and lead to feelings of depression and anxiety.

- Disability and decreased lifespan: Severe COPD can make it difficult to perform daily activities and can significantly reduce lifespan.

How Life Insurance Companies Evaluate COPD:

Life insurance companies evaluate COPD based on the severity of the disease, the age of the applicant, and the presence of other health conditions. The severity of COPD is typically determined by the results of pulmonary function tests, including spirometry and arterial blood gas analysis.

Life insurance companies use a rating system to evaluate applicants with COPD. The rating system is based on the severity of the disease and the applicant’s overall health. Applicants with mild to moderate COPD may be approved for life insurance coverage with a higher premium rate.

However, applicants with severe COPD may be declined for coverage or may only be eligible for a guaranteed issue life insurance policy, which typically has a lower death benefit and higher premium rates.

That said, we should point out that anyone applying for a traditional life insurance policy with a diagnosis of COPD will be immediately denied coverage if the applicant has used any type of nicotine or tobacco product within the past 12 months

What You Can Do to Increase Your Chances of Getting Approved for Life Insurance Coverage:

If you have COPD, there are several things you can do to increase your chances of getting approved for life insurance coverage.

- Quit smoking: Smoking is the leading cause of COPD. If you are a smoker, quitting smoking can improve your health and increase your chances of getting approved for life insurance coverage.

- Follow your treatment plan: Following your treatment plan, including taking medications and participating in pulmonary rehabilitation, can help manage your COPD symptoms and improve your overall health.

- Maintain a healthy lifestyle: Maintaining a healthy lifestyle, including regular exercise and a healthy diet, can improve your overall health and reduce the risk of complications from COPD.

- Shop around: Different life insurance companies have different underwriting guidelines for COPD. Shopping around and working with an experienced life insurance agent can help you find a life insurance company that is more likely to approve your application.

- Consider a guaranteed issue life insurance policy: If you are unable to obtain traditional life insurance coverage, a guaranteed issue life insurance policy may be an option. Guaranteed issue policies typically have lower death benefits and higher premium rates, but they do not require a medical exam or health questionnaire.

Guaranteed issue life insurance policy

Guaranteed issue life insurance policies are a type of life insurance policy that is available to anyone who applies, regardless of their health status. These policies are typically sold with no medical exam or health questions, meaning that the policyholder is guaranteed to be accepted for coverage as long as they meet the age requirements and other criteria.

Pros of Guaranteed Issue Life Insurance Policies:

- Easy to Obtain: Guaranteed issue life insurance policies are easy to obtain, and almost everyone who applies will be accepted.

- No Medical Exam Required: There is no medical exam required to apply for a guaranteed issue life insurance policy, which can be a big advantage for individuals with pre-existing health conditions like COPD.

- Death Benefit: Guaranteed issue life insurance policies pay out a death benefit to the policyholder’s beneficiaries when the policyholder passes away.

Cons of Guaranteed Issue Life Insurance Policies:

- Higher Premiums: Guaranteed issue life insurance policies are typically more expensive than traditional life insurance policies. This is because the insurer is taking on a higher risk by insuring individuals who may have health problems.

- Lower Coverage Amounts: Guaranteed issue life insurance policies usually offer lower coverage amounts than traditional life insurance policies. This is because the insurer is taking on a higher risk by insuring individuals who may have health problems.

- Waiting Periods: Guaranteed issue life insurance policies often have waiting periods before the policyholder’s beneficiaries can receive the full death benefit. This waiting period can range from two to three years, depending on the policy.

- No Cash Value: Guaranteed issue life insurance policies do not accumulate cash value, which means that the policyholder cannot borrow against the policy or receive any other type of cash payout.

In conclusion, guaranteed issue life insurance policies can be a good option for individuals who have been diagnosed with COPD and are unable to qualify for traditional life insurance policies. These policies are easy to obtain and require no medical exam, but they often have higher premiums, lower coverage amounts, waiting periods, and no cash value.

Summation:

COPD is a chronic respiratory disease that can affect your ability to obtain life insurance coverage. However, by following your treatment plan, maintaining a healthy lifestyle, and working with an experienced life insurance agent, you can increase your chances of getting approved for life insurance coverage. If you are unable to obtain traditional life insurance coverage, a guaranteed issue life insurance policy may be an option. Ultimately, the best way to increase your chances of getting approved for life insurance coverage with COPD is to take control of your health and work with a knowledgeable life insurance agent.

Frequently Asked Questions

Can I get life insurance if I have COPD?

Yes, individuals with COPD can still get life insurance, but it may be more difficult to qualify for traditional life insurance policies. Guaranteed issue life insurance policies are a good option for those who are unable to qualify for traditional policies.

What type of life insurance policy should I get if I have COPD?

The type of life insurance policy you should get depends on your individual circumstances. If you are able to qualify for a traditional life insurance policy, it may be the best option as it offers higher coverage amounts and lower premiums. However, if you are unable to qualify for a traditional policy, guaranteed issue life insurance policies may be the best option.

Will I have to pay higher premiums if I have COPD?

Individuals with COPD may have to pay higher premiums for life insurance due to their increased health risk. The exact cost of your premiums will depend on the severity of your condition and other factors, such as age and lifestyle.

Do I need to disclose my COPD diagnosis when applying for life insurance?

Yes, it is important to disclose any pre-existing health conditions, including COPD, when applying for life insurance. Failure to disclose this information can result in denial of coverage or cancellation of your policy.

How can I improve my chances of getting approved for life insurance with COPD?

Maintaining good overall health, quitting smoking, and following your doctor’s treatment plan can all improve your chances of getting approved for life insurance with COPD. It’s also important to work with an experienced life insurance agent who can help you find the best policy for your individual circumstances.

What are some common causes of COPD?

Smoking and other tobacco use are the primary causes of COPD. Other causes include exposure to air pollution, occupational dust and chemicals, and genetic factors.

What are some symptoms of COPD?

Common symptoms of COPD include shortness of breath, coughing, wheezing, and chest tightness. These symptoms can vary in severity and may worsen over time.

What are some treatment options for COPD?

Treatment options for COPD include medications, oxygen therapy, pulmonary rehabilitation, and lifestyle changes. It’s important to work with your doctor to develop a treatment plan that is tailored to your individual needs.

What is the worst-case scenario for someone with COPD?

The worst-case scenario for someone with COPD is severe lung damage and difficulty breathing, which can lead to hospitalization or even death. COPD is a progressive disease, meaning that symptoms may worsen over time, making it important to manage the condition with the help of a medical professional.

How does smoking affect my chances of getting life insurance with COPD?

Smoking is a major risk factor for COPD and will make it impossible to qualify for a traditional life insurance policy. If you are a smoker, it’s important to quit as soon as possible to improve your overall health and increase your chances of getting approved for life insurance.

Can I still get life insurance if I use oxygen therapy for my COPD? Yes, individuals who use oxygen therapy for COPD can still get life insurance. However, requiring the use of oxygen will significantly decrease the likelihood that one will be able to qualify for a traditional life insurance policy. In cases like these a guaranteed issue life insurance policy may be your best option.

How can I find the best life insurance policy for my individual needs?

In our opinion, the best way to find the best life insurance policy for your individual needs is to work with an experienced life insurance agent. They can help you compare rates and coverage options from multiple insurance providers and find the policy that best fits your needs and budget.