Life insurance is essential for anyone who wants to ensure that their loved ones are financially secure in the event of their untimely death. However, for individuals with cerebral palsy, getting approved for life insurance can be a challenge.

In this article, we will discuss the process of obtaining life insurance with cerebral palsy and provide tips for getting approved.

Understanding Life Insurance with Cerebral Palsy

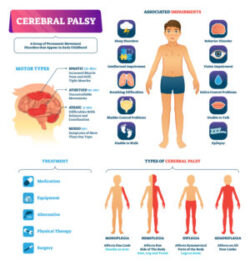

Cerebral palsy (CP) is a group of neurological disorders that affect movement, muscle tone, and coordination. It is the most common motor disability in childhood, affecting about 1 in 500 children worldwide. CP is caused by damage to the developing brain, usually before or during birth, although it can also occur in the first few years of life.

Causes of Cerebral Palsy

The exact cause of cerebral palsy is not always clear, but it is often related to brain damage that occurs during fetal development or early childhood. Some common causes of cerebral palsy include:

- Lack of oxygen during birth or delivery.

- Infections during pregnancy.

- Trauma to the head during birth or early childhood.

- Genetic mutations.

- Premature birth or low birth weight.

- Maternal health issues during pregnancy.

Symptoms of Cerebral Palsy

The symptoms of cerebral palsy can vary widely from person to person, depending on the severity and type of CP. Some common symptoms of cerebral palsy include:

- Difficulty with motor skills, such as walking, sitting, or standing.

- Involuntary movements, such as tremors or spasms.

- Abnormal muscle tone, such as stiffness or floppiness.

- Difficulty with fine motor skills, such as writing or buttoning clothes.

- Speech and language delays or difficulties.

- Intellectual disabilities or learning disabilities.

- Vision or hearing problems.

- Seizures.

Treatment for Cerebral Palsy

While there is currently no cure for cerebral palsy, there are several treatments and therapies that can help manage the symptoms of CP and improve quality of life. Some common treatments for cerebral palsy include:

- Physical therapy to improve motor function and muscle strength.

- Occupational therapy to improve fine motor skills and daily living activities.

- Speech therapy to improve communication and swallowing abilities.

- Medications to manage symptoms, such as muscle relaxants or anticonvulsants.

- Surgery to correct muscle or bone abnormalities or to implant devices to improve mobility.

Worst-Case Scenarios of Cerebral Palsy

In some cases, the symptoms of cerebral palsy can be severe and may result in long-term disabilities or health complications. Some worst-case scenarios of cerebral palsy include:

- Severe intellectual disabilities.

- Severe physical disabilities that require full-time care.

- Difficulty with breathing or swallowing.

- Chronic pain or discomfort.

- Vision or hearing loss.

- Seizures that are difficult to manage with medication.

- Increased risk of mental health issues, such as depression or anxiety.

It is important to note that these worst-case scenarios are not typical for individuals with cerebral palsy, and many people with CP live fulfilling and independent lives with appropriate treatment and support.

Impact on a traditional life insurance application

Cerebral palsy can have an impact on a life insurance application, as individuals with this condition may be considered higher risk by insurance companies. This is because individuals with cerebral palsy may have a higher risk of health complications and a shorter life expectancy compared to individuals without the condition.

In general, what you’re typically going to find is that individuals with cerebral palsy may only qualify for life insurance at a substandard or table rating. This means that they will typically pay a higher premium compared to individuals without the condition. The amount of the premium increase will depend on the severity of the cerebral palsy, the individual’s overall health, and the insurance company’s underwriting guidelines.

A substandard or table rating is used to indicate an increased risk for the insurance company. The rating is typically assigned based on the individual’s medical history, including any past or present health conditions, medications, and treatments. The rating may also be based on the results of a medical exam, which can include tests to measure cognitive and physical functioning.

The table rating system used by insurance companies typically ranges from Table A to Table J or higher, with Table A being the least risky and Table J being the most risky. Each table represents a specific percentage increase in the standard premium. For example, a Table A rating may result in a 25% increase in the standard premium, while a Table J rating may result in a 250% or higher increase.

It is important to note that the substandard or table rating assigned to an individual with cerebral palsy may vary between insurance companies. This is because each company has its own underwriting guidelines and may place different weight on certain risk factors. It is therefore important to work with an experienced insurance agent who can help you compare policies and rates from multiple companies and find the policy that best fits your needs and budget.

Tips for Getting Approved for Life Insurance with Cerebral Palsy

Getting approved for life insurance with cerebral palsy can be challenging, but there are steps that individuals with the condition can take to increase their chances of getting approved. Here are a few tips to keep in mind:

Work with an experienced insurance agent.

Working with an experienced insurance agent who has experience working with individuals with pre-existing medical conditions can be incredibly helpful. An experienced agent can help you navigate the application process and find an insurance company that is more likely to approve your application.

Be honest on your application.

It is essential to be honest on your life insurance application, especially when it comes to your medical history. Providing false information could result in a denial of coverage, and it could also put your loved ones at risk of not receiving the death benefit if you were to pass away.

Prepare for the medical exam.

If the insurance company requires a medical exam, it is important to prepare for the exam to ensure that you get accurate results. This may involve reviewing your medical records with your doctor and making sure that any medications or treatments that you are receiving are properly documented.

Provide additional documentation.

In some cases, it may be helpful to provide additional documentation to the insurance company to support your application. This may include letters from your doctors, documentation of any treatments or therapies that you are receiving, and information about how your condition is managed.

What if I can’t qualify for a traditional life insurance policy?

If you are unable to qualify for a traditional life insurance policy due to cerebral palsy or any other health condition, guaranteed issue life insurance may be an option to consider.

Guaranteed issue life insurance:

Guaranteed issue life insurance policies do not require a medical exam or health questionnaire, which means that individuals with cerebral palsy may be able to qualify for coverage regardless of their health status. Here are some pros and cons to consider when it comes to:

Pros:

- Guaranteed acceptance: As mentioned, guaranteed issue life insurance policies do not require a medical exam or health questionnaire. This means that individuals with cerebral palsy who may have difficulty obtaining traditional life insurance coverage due to their condition can still obtain coverage with a guaranteed issue policy.

- Simplified application process: Without the need for a medical exam or health questionnaire, the application process for guaranteed issue life insurance is typically much simpler and quicker compared to traditional policies.

- No health-related exclusions: Unlike traditional life insurance policies that may exclude coverage for certain health conditions or complications related to cerebral palsy, guaranteed issue policies typically do not have any health-related exclusions.

Cons:

- Higher premiums: Guaranteed issue life insurance policies typically have higher premiums compared to traditional policies. This is because the insurance company is taking on a higher risk by insuring individuals without a full understanding of their health status.

- Lower death benefit: Guaranteed issue policies may offer lower death benefits compared to traditional policies. This means that the payout to your beneficiaries in the event of your death may not be as substantial as with a traditional policy.

- Waiting period: Most (if not all) guaranteed issue life insurance policies have a waiting period before the death benefit is paid out. This waiting period can range from two to three years, depending on the policy.

Accidental death policies

Accidental death policies on the other hand, provide coverage specifically for accidental deaths. These policies typically do not require a medical exam or health questionnaire and are therefore easier to obtain compared to traditional life insurance policies. Here are some pros and cons to consider when it comes to accidental death policies:

Pros:

- Lower premiums: Accidental death policies typically have lower premiums compared to traditional life insurance policies because they only cover accidental deaths.

- No medical exam required: Accidental death policies do not require a medical exam or health questionnaire, which means that individuals with cerebral palsy may be able to obtain coverage regardless of their health status.

- Coverage for accidental deaths: Accidental death policies provide coverage specifically for accidental deaths, which may provide peace of mind for individuals who engage in high-risk activities.

Cons:

- Limited coverage: Accidental death policies only provide coverage for accidental deaths, which means that deaths due to illness or natural causes are not covered.

- Limited death benefit: Accidental death policies may offer lower death benefits compared to traditional life insurance policies, which means that the payout to your beneficiaries in the event of your death may not be as substantial.

- Exclusions and limitations: Accidental death policies may have exclusions and limitations on coverage for certain types of accidents, such as those related to drug or alcohol use.

Final Thoughts…

Obtaining life insurance with cerebral palsy can be challenging, but it is not impossible. By shopping around for a policy, being honest on your application, preparing for the medical exam, and providing additional documentation, you can increase your chances of getting approved for coverage. Working with an experienced insurance agent can also be incredibly helpful in navigating the application process and finding the right policy for your needs.