Life insurance is a vital financial tool that helps protect your loved ones from financial hardship in the event of your untimely death. It provides a death benefit that can be used to pay for final expenses, debts, and provide ongoing financial support to your family. If you have ascites, a condition characterized by the accumulation of fluid in the abdomen, you may have questions about how it will impact your ability to obtain life insurance.

In this article, we have compiled some of the most common questions people with ascites have about life insurance and provided answers to help you better understand your options and qualify for the best policy possible.

By the end of this article, we hope that you will feel empowered to make informed decisions about your life insurance coverage.

Frequently Asked Questions

What is ascites, and why do life insurance companies care if I have been diagnosed with it?

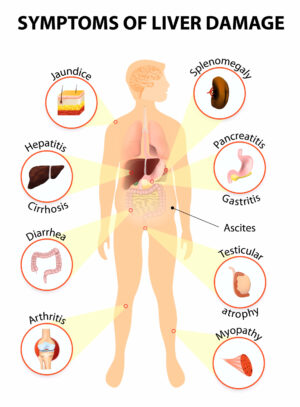

Ascites is a medical condition characterized by the accumulation of fluid in the abdominal cavity. It is often associated with liver disease, although it can also be caused by other medical conditions such as cancer or heart failure.

Life insurance companies care if you have been diagnosed with ascites because it is a pre-existing medical condition that could affect your life expectancy and increase the risk of a premature death. This could make it more difficult for you to qualify for traditional life insurance policies, which typically require medical underwriting and may involve a medical exam.

Guaranteed issue life insurance policies, on the other hand, are designed to provide coverage without any medical underwriting or exams, so they may be a good option if you have been diagnosed with ascites or another pre-existing condition. However, these policies typically have lower coverage amounts and higher premiums than traditional life insurance policies.

In summary, ascites is a medical condition that can affect your ability to qualify for traditional life insurance policies due to its potential impact on life expectancy and health.

Can I still qualify for life insurance if I have ascites?

Unfortunately, a diagnosis of ascites most likely makes it impossible for you to qualify for a traditional term or whole life insurance policy. However, you may still be eligible for a guaranteed issue life insurance policy if you meet certain age and residency requirements. It’s important to note that guaranteed issue policies typically have lower coverage amounts and higher premiums, so it’s crucial to speak with a licensed insurance agent to determine the best policy for your needs.

Will my ascites affect my life insurance rates?

Because you will most likely only be eligible for a guaranteed issue life insurance policy, your ascites diagnosis should not affect your rate. This is because, Guaranteed issue policy rates are usually determined based on your age, gender, and sometimes your state of residence. It’s important to compare the rates and coverage amounts of different policies to ensure you are getting the best value for your money.

Will I need to undergo a medical exam to qualify for life insurance with ascites?

Guaranteed issue life insurance policies typically do not require a medical exam or any medical underwriting. This means that your ascites, or any other pre-existing condition, will not be taken into consideration when determining your eligibility or rates. Guaranteed issue policies are generally easier to qualify for, but they usually have lower coverage amounts and higher premiums compared to traditional life insurance policies.

How will my medical history and current condition impact my life insurance application?

Guaranteed issue life insurance policies do not require medical underwriting, so your medical history and current condition will not directly impact your eligibility or rates. However, some insurance companies may still ask about your medical history on the application form, even for guaranteed issue policies. This information may be used to determine your eligibility for other insurance products offered by the company, but it will not impact your approval for a guaranteed issue policy.

Will I be required to provide additional medical documentation when applying for life insurance with ascites?

For guaranteed issue life insurance policies, additional medical documentation is typically not required. These policies are designed to provide coverage without any medical underwriting, so the application process is usually simple and straightforward. However, it’s important to note that insurance companies may still ask some basic questions about your health and medical history on the application form, even for guaranteed issue policies.

How much life insurance coverage can I expect to qualify for with ascites?

Guaranteed issue life insurance policies typically have a maximum coverage amount of $25,000 or less, depending on the insurance company. If you need more coverage, you may need to consider applying for multiple policies, which can become expensive over time.

Will I need to disclose my ascites to my life insurance company?

Yes, it is important to disclose any pre-existing medical conditions, including ascites, to your life insurance company when applying for a policy. Failure to disclose this information could result in your policy being canceled or denied if the insurance company discovers the omission later on.

Additionally, some insurance companies may require you to provide medical records or other documentation to support your application, and the information contained in these documents may reveal your pre-existing conditions. It’s important to be honest and transparent on your application to ensure that you get the right coverage for your needs.

That said, however, if you are only applying for a guaranteed issue life insurance policy, you probably won’t be asked or required to disclose anything about your current health status.

How can I ensure that I get the best life insurance policy possible despite my ascites?Here are some tips to help you get the best life insurance policy possible despite having ascites:

- Shop around: Take the time to compare different insurance companies and policies to find the best coverage and rates for your needs.

- Work with an experienced agent: An experienced insurance agent can help you navigate the application process and find policies that are specifically designed for people with pre-existing conditions like ascites.

- Be upfront about your medical history: Disclose any pre-existing medical conditions, including ascites, on your application form. This will ensure that you get the coverage you need and avoid any issues with your policy in the future.

- Consider guaranteed issue policies: Guaranteed issue life insurance policies may be a good option if you have been unable to qualify for traditional life insurance due to your medical history.

- Consider other types of insurance: If you are unable to qualify for traditional life insurance, consider other types of insurance such as accidental death or final expense insurance.

- Take steps to manage your condition: Taking steps to manage your ascites, such as following your doctor’s treatment plan and maintaining a healthy lifestyle, can improve your overall health and make it easier to qualify for life insurance coverage.

Remember, it’s important to speak with a licensed insurance agent to determine the best coverage options for your specific needs and situation.