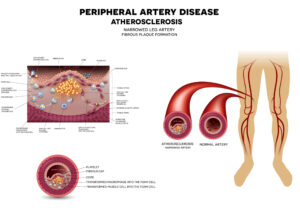

In this article, we will explore the challenges faced by individuals with PVD when applying for life insurance and discuss the factors that insurance companies consider when evaluating such applications. We will also provide some helpful tips to improve your chances of obtaining life insurance approval if you have been diagnosed with Peripheral Vascular Disease. [...]

Life insurance provides financial protection to individuals and their families in the event of death or disability. However, securing life insurance coverage can be challenging for individuals with certain health conditions, such as peripheral polyneuritis. In this article, we will explore what peripheral polyneuritis is, its impact on life insurance approvals, and provide insights on [...]

Securing life insurance is an important financial decision that provides peace of mind for individuals and their loved ones. However, navigating the life insurance application process can be complex, especially for those with pre-existing medical conditions. One such condition is pericarditis, an inflammation of the pericardium, the protective sac surrounding the heart. In this article, [...]

Obtaining life insurance is an important step in ensuring financial security for your loved ones. However, individuals with certain health conditions may find it challenging to secure life insurance coverage. One such condition is Patent Ductus Arteriosus (PDA), a congenital heart defect that affects the ductus arteriosus, a blood vessel in the heart. In this [...]

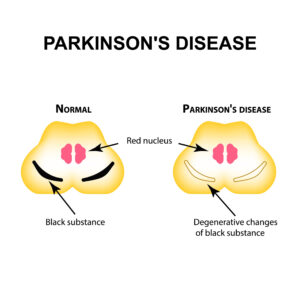

Securing life insurance is an essential step in safeguarding the financial future of you and your loved ones. However, individuals living with Parkinson’s disease may face unique challenges when it comes to obtaining life insurance coverage. In this article, we will delve into the intricacies of life insurance approvals for those with Parkinson’s disease and [...]

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. However, when living with a disability like paraplegia, obtaining life insurance coverage can be a complex process. In this article, we will explore how life insurance approvals with paraplegia can be obtained, the factors influencing [...]

Life insurance plays a crucial role in safeguarding the financial future of individuals and theirloved ones. When it comes to choosing the right life insurance provider, American International Group (AIG) is a name that often comes up. With a rich history and global presence, AIG has established itself as a prominent player in the life [...]

It’s time you start considering to purchase a life insurance policy to cover all your final expenses such as burial needs, lost wages for loved ones who need to take off, and funeral costs. But which life insurance company has the most to offer? Assurity Life Insurance Company is one of the top final expense [...]

While it can be challenging to get approved for life insurance with pancytopenia, it is possible. In this article, we will explore the process of getting approved for life insurance with pancytopenia and provide some helpful tips to increase your chances of approval. Understanding Pancytopenia Pancytopenia refers to the simultaneous reduction in the number of [...]

If you’ve found your way to this page it means you’re probably doing research about the top final expense and burial insurance companies, and you’re wondering if Mutual of Omaha is the best life insurance company for you. Well, you’ve come to the right place to find out! JustBuryMe helps life insurance seekers like you [...]